VIDEO The first of three press conferences on tax-tax reform:

- according to the proposed reform, a working parent can receive 200 euros per month per child, a non – working parent only 100

- child allowances will be increased from 25.50 to 30 euros for children under 18, in the case of older children up to the end of full-time university studies to 50 euros

- the state will set 70 euros for children from 3 to 18 years of age for any group that will be paid with a special card, such as tutoring or other activities that develop the child’s talent

- tax bonus for children under 18 years in the amount of 70 euros

- the recreational bonus will increase to 30 euros per month

Members of We are a family came to see Matovic

Matovič apparently also invited coalition representatives from We Are a Family to the presentation of the reform, namely the Speaker of the Parliament Boris Kollár and the Minister of Labor Milan Krajniak. However, neither the SaS nor Za lidí members were at the press conference.

Source: Topky / Ján Zemiar

Support for families with children will be higher

The state is preparing to support families with children to a greater extent than before. He proposes to increase child allowances from € 25.50 per month to € 30 up to the age of 18 and to € 50 per month from the age of 18 until the completion of full-time university studies.

Source: Topky / Ján Zemiar

Contributions to the rings are Matovič’s heart

Another change should be to increase the allowance for clubs and tutoring from € 12 per child to € 70. In addition, these contributions will be paid on a special card so that they are not misused for other purposes, but the details of this card have not yet been revealed by the ministry. Allowances are expected to be distributed through a specific server. Matovic called this part of the reform as the so-called services to children and he admitted that it was his “heartbeat”.

“It has to do with the fact that hundreds of thousands of children do not go to any clubs,” the minister stated that it was probably for the family’s financial reasons. The Ministry of Finance proposed to increase the contribution for circles and tutoring from the current 12 euros (roughly the state spends for this purpose, but families do not receive them directly) to 70 euros per month, for children from three to 18 years of age. However, the contribution would not be automatic, it would be earmarked money. “This means that on a card or electronic account, where their child could really only draw on services for children,” Matovič outlined that the money could be used for clubs, tutoring, admission to the theater, gallery and, for older children, for example, admission to the gym. This would burden the budget by € 570 million a year more than at present.

Source: Topky / Ján Zemiar

Tax bonus

The next part – the tax bonus – already applies to the children of working parents. Depending on the age of the child, it is currently at around 23 to 46 euros per month. “The new proposal is that for all children under the age of 18 (not until the end of university), a working parent can draw up to 70 euros,” said the minister. According to Matovič’s words, the change will not only occur in the amount itself, but also in the condition that the parent must earn within a year in order to be entitled to the bonus. “We propose that from the first euro of earnings, the parent actually earns a tax bonus at twice the tax rate, ie 38% of the parent’s gross salary.” the minister added, adding that he considered it a magnet for non-working parents to go to work. This increase in the tax bonus will cut the budget by 269 million more per year than at present.

Who gets more?

Contributions are based on whether they are working or non-working parents. For a family where at least one parent works, these measures together give € 200 per child per month, for non-working parents € 100.

Source: Topky / Ján Zemiar

The last part of the changes also concerns the allowance for the child of working parents, specifically it is a recreational bonus. The minister currently estimated it at around six euros (including a reduced VAT rate on accommodation and a holiday voucher for employees). After the new one, he wants to increase it to 30 euros for a child under 18 years of age. However, it is also a “card” measure, ie the money must be used for specific purposes, namely to support domestic tourism. In addition, it will cut 254 million euros a year from the budget.

Source: Topky / Ján Zemiar

The state will pay for it, Matovič wants to cut out Naď’s finances as well

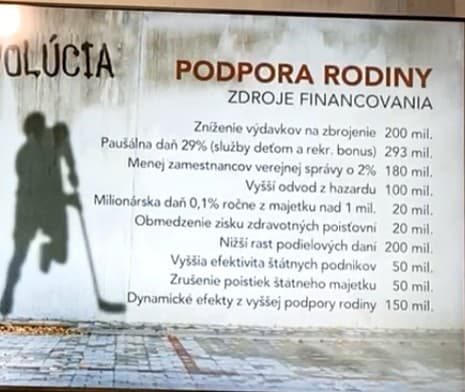

An increase in family support will cut an additional € 1.2 billion from the budget. For example, millionaire tax of 0.1% per year on assets over one million euros is to be used for financing, which, however, will require a property declaration of everyone who has assets worth more than one million euros.

Below are other items that the reform needs to implement:

Source: Topky / Ján Zemiar

Other measures financing the reform included, for example, a two percent reduction in public administration staff and a reduction in armaments spending by the Ministry of Defense, led by its own minister, Jaroslav Naď (OĽANO). “I think that if our NATO partners invest dramatically less than we do, it should be a little wait.” Matovic argued.

Flat tax 29%

Another item that should co-finance increased support for families with children is the introduction of a flat-rate withholding tax of 29% on the provision of services to children and on services related to the recreational bonus. This would bring the state 293 million euros a year. It would in principle be a tax rate for the person who provides these services directly. Contributions from children’s “cards” that are transferred to a service provider, such as a football coach, are to be taxed.

Reduction in the number of public administration employees and gambling levy

Matovic also proposed to reduce the number of public administration employees by two percent, which would save the state 180 million euros. He argued that the state employs more than 440,000 employees, which Slovakia can no longer afford to finance.

Another item – a higher gambling levy – would bring 100 million euros to the state treasury, according to calculations by the Ministry of Finance.

Millionaire’s tax

A million% tax per year would bring in EUR 20 million. However, according to the Minister, the aim of introducing such a tax is, in addition to solidarity, that every person who has property in Slovakia in excess of one million euros would have to file a property declaration once a year. According to him, the financial administration would then be able to control the tax paid more easily.

“The sixth source of funding is to limit the profits of health insurance companies to 20 million euros,” the minister continued. The proposals also include a lower share tax increase of € 200 million. Municipalities will lose them.

State property insurance is now in the form of a big theft

Among other sources of financing, Matovič included higher efficiency of state-owned enterprises, which would contribute EUR 50 million a year to financing the reform. He cited the state-owned company Tipos as an example, which he said had dramatically increased turnover and profits.

Source: Topky / Ján Zemiar

The state could also save 50 million euros on the cancellation of state property insurance. “It’s one big thief today,” the minister stated that the business should be abolished. According to Matovič’s ministry, the remaining 150 million euros a year will bring dynamic effects from higher family support. “When you give families an extra 1.2 billion euros and they spend that money, whether on consumption or services for children or on home recreation, you put that money into the economy and then generate new jobs, higher income taxes, VAT, levies – these are so-called dynamic effects, “ concluded the minister.

VIDEO Matovič answers questions about the first part of the tax-tax reform:

The Kollárovs welcome the reform

The chairman We Are Family, who was at the briefing with Minister Krajniak, claims that the content of the “tax revolution” did not surprise him, as they have been talking about it in the coalition for a long time. “It was such an open debate and we commented on things we did not like. I support what Minister Matovic presented today,” said Krajniak, with Kollár saying in front of him that this is also proof that “We are a family not fighting for reform”.

Download Owais Raza Qadri – Chaman E Taiba Album Mp3 Zip

Download BIGYUKI – Neon Chapter Album Mp3 Zip

Download Format Celli – From Above Album Mp3 Zip

Download Tim Chesley – The Last Blue Sky – EP Album Mp3 Zip

Download Siqingerile – 姿態 Album Mp3 Zip

Download Stephen Ray Lester – Outlaw Banjo Basterd Album Mp3 Zip

Download GRACEY – Fragile – EP Album Mp3 Zip

Download Nariaki Obukuro – Strides Album Mp3 Zip

Download Miles Davis – Miles Davis Jazz Monument Album Mp3 Zip

Download Part Time – Virgo’s Maze Album Mp3 Zip

Download Joliet – Joliet – EP Album Mp3 Zip

Download i-sef u-sef – Shaghara Lemoune Album Mp3 Zip

Download Asunto – Renacer – EP Album Mp3 Zip

Download Andy Joel – Charismatic, Vol. 2 Album Mp3 Zip

Download Varios Artistas – Captain of Poong-New (Korean Traditional Music meets Pop Music) Episode 3 – EP Album Mp3 Zip

Download Night-Time Jazz, Relax Jazz Music & Jazz 8D – Relaxing Jazz Nights Album Mp3 Zip

Download D.J. Highlanders – Great Oceans, Vol. 2 – EP Album Mp3 Zip

Download Roman Messer – Suanda Music Episode 298 (DJ MIX) Album Mp3 Zip

Download THE CHARM PARK – Floating Forever Album Mp3 Zip

Download Le Blaze – La Tape Album Mp3 Zip

Download Joost Spijkers – Hotel Spijkers Album Mp3 Zip

Download △Sco△ – Eternal Sunshine of the Spotless Mind Album Mp3 Zip

Download bjons – CIRCLES Album Mp3 Zip

Download Mone Kamishiraishi – I’ll Be There / Spin – EP Album Mp3 Zip

Download Duwap Kaine – HardHead Album Mp3 Zip